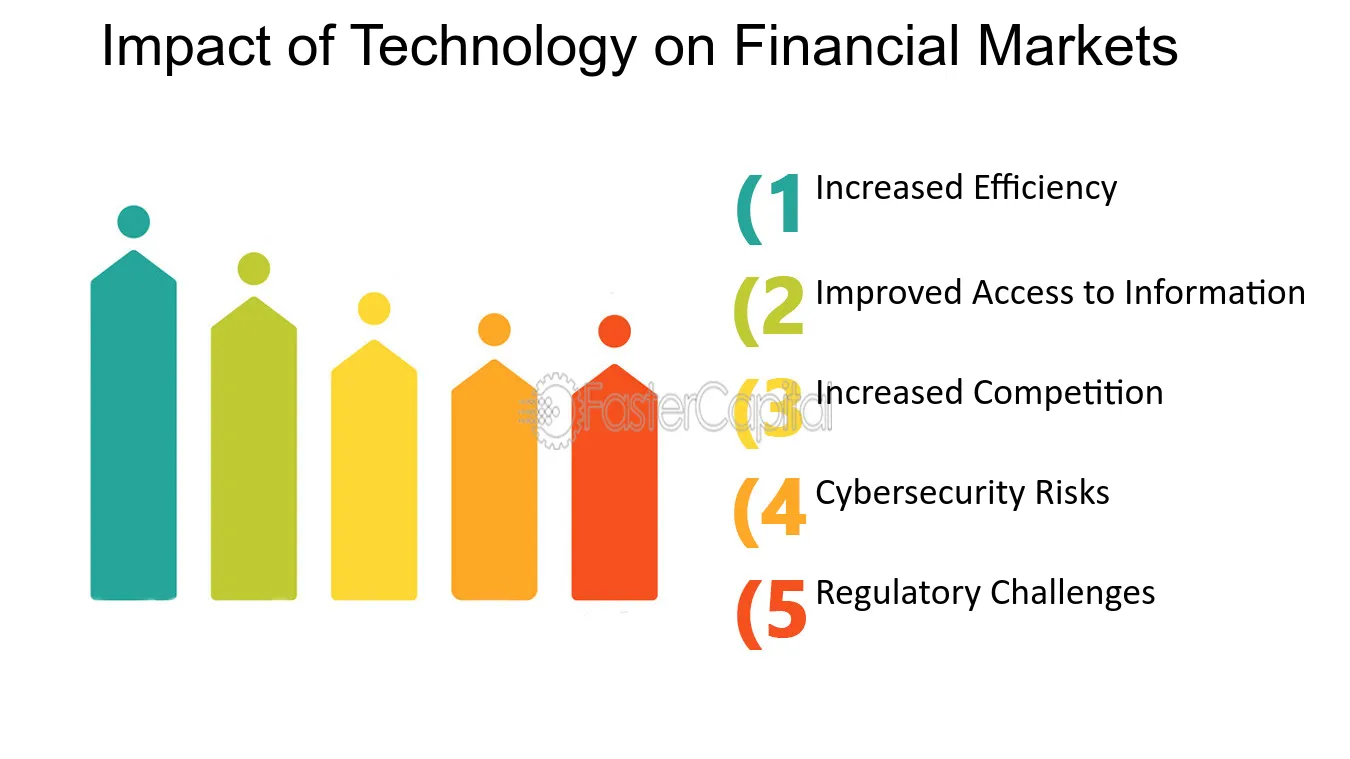

Information Technology (IT) has transformed the finance industry, creating more efficient processes and innovative solutions. The integration of IT in finance has enabled faster transactions, improved customer service, and more accurate data analysis. This evolution has reshaped financial services, creating new opportunities and challenges for both businesses and consumers. To get better idea about finance please visit https://www.cardfusions.com/.

Enhanced Data Management and Analytics

The adoption of IT in finance has revolutionized data management. Financial institutions now handle vast amounts of data daily. With advanced IT systems, they can store, process, and analyze data more efficiently. This enables companies to make data-driven decisions, which improves risk management and business strategies. Know more about advanced IT systems from https://www.protechquest.com/.

Furthermore, financial data analytics has grown to include predictive models and artificial intelligence (AI). These technologies analyze trends and patterns in customer behavior, helping banks tailor personalized services. This not only improves customer satisfaction but also aids in identifying potential risks and investment opportunities.

Improved Customer Experience Through Digital Banking

Digital banking, powered by IT, has become a key component of modern financial services. Customers can now access banking services through mobile apps, websites, and digital platforms. This convenience has changed how people manage their finances, providing them with access to services like online payments, account management, and loan applications.

With features such as chatbots and virtual assistants, financial institutions can offer 24/7 customer support. These AI-driven solutions provide instant responses to customer queries, ensuring a seamless banking experience. This shift towards digital banking has increased customer engagement and loyalty, as clients appreciate the ease and speed of accessing financial services.

Automation of Financial Processes

Automation in finance, driven by IT, has reduced the manual burden of routine tasks. Processes like payment processing, account reconciliation, and reporting are now automated, which saves time and reduces human errors. This automation leads to cost savings for banks and other financial institutions, allowing them to allocate resources to more strategic activities.

Moreover, robotic process automation (RPA) helps streamline back-office operations, improving efficiency and accuracy. By automating compliance and reporting, banks ensure adherence to regulatory requirements without excessive manual intervention. This boosts overall productivity and minimizes the risk of regulatory penalties.

Enhanced Security and Fraud Detection

With the increasing digitization of financial services, cybersecurity has become crucial. IT has provided advanced security measures like encryption, multi-factor authentication, and biometric verification. These tools protect sensitive financial data and ensure secure online transactions, enhancing customer trust.

Additionally, AI and machine learning algorithms help detect fraudulent activities in real time. They analyze transaction patterns and flag any suspicious behavior, reducing the risk of cyberattacks. This proactive approach to security enables financial institutions to safeguard customer data and maintain the integrity of their operations.

Accessibility to Financial Markets and Services

Information technology has made financial markets more accessible to investors globally. Online trading platforms and mobile applications allow users to buy and sell stocks, bonds, and other securities from anywhere. This increased accessibility has democratized investing, giving retail investors the tools they need to participate in financial markets.

Moreover, IT has enabled fintech solutions like peer-to-peer lending, digital wallets, and cryptocurrency exchanges. These innovations have broadened the range of financial services available to the public, offering alternatives to traditional banking and investment channels. As a result, more people can access and leverage financial products that were once restricted to institutional investors.

Cost Efficiency and Scalability for Financial Institutions

The integration of IT in finance has significantly reduced operational costs. Cloud computing and data storage solutions allow financial institutions to scale their operations without heavy investment in physical infrastructure. This flexibility enables banks to expand their services quickly and adapt to market changes.

Furthermore, by leveraging IT solutions, companies can manage global operations from a central location. This reduces costs related to physical branches and allows for seamless service delivery across different regions. Financial institutions can also quickly launch new digital products and services, staying competitive in an ever-evolving market.

Conclusion

The impact of IT on finance is profound, driving innovation, efficiency, and accessibility across the industry. Financial institutions that embrace IT can better serve customers, streamline operations, and remain competitive in a digital-first world. As technology continues to evolve, the financial sector will face new opportunities and challenges, shaping the future of banking and investment.

Frequently Asked Questions

How has IT changed the banking sector?

IT has made banking more accessible, secure, and efficient. It enables digital banking, automates processes, and improves data management. This has led to a better customer experience and streamlined operations, making banks more agile in a digital economy.

What role does AI play in finance?

AI plays a significant role in financial analytics, fraud detection, and customer service. It helps analyze vast data sets, predict market trends, and automate customer interactions through chatbots and virtual assistants, improving decision-making and service quality.

How has IT impacted investment and trading?

IT has enabled online trading platforms, making investment opportunities accessible to a global audience. Investors can trade stocks, bonds, and cryptocurrencies from anywhere. This digital shift has made markets more inclusive and responsive to real-time data.

Why is cybersecurity important in finance?

Cybersecurity is crucial to protect sensitive financial data and ensure the integrity of online transactions. Advanced IT tools like encryption and multi-factor authentication safeguard against cyber threats, helping maintain customer trust in digital services.

What are fintech solutions?

Fintech solutions are technological innovations that offer financial services, such as digital wallets, peer-to-peer lending, and cryptocurrency exchanges. They provide alternative ways for consumers to access financial services outside traditional banking systems.